BlackRock and Vanguard, are two of the world's largest asset managers, they are at the forefront of leveraging AI to reshape investment strategies. BlackRock, in particular, has created systematically incorporating AI into its operations for nearly two decades. The company's deep integration of large language models (LLMs) into its investment processes is a game-changer. The AI models are designed to analyze security and market data with very good precision, enhancing the firm's ability to predict market behaviour and make data-driven decisions.

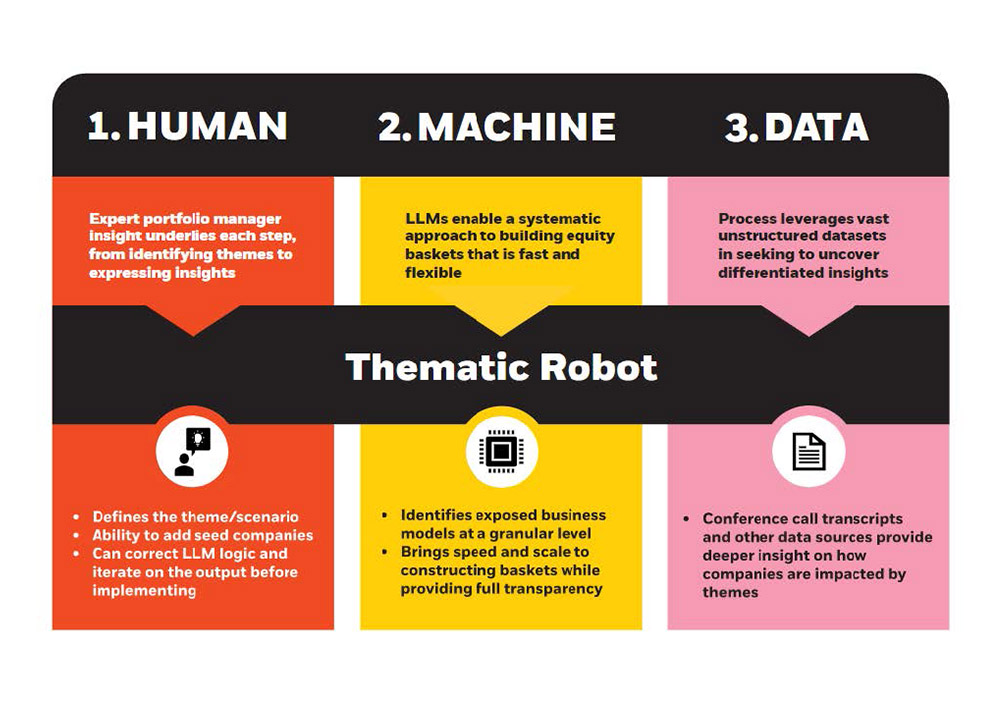

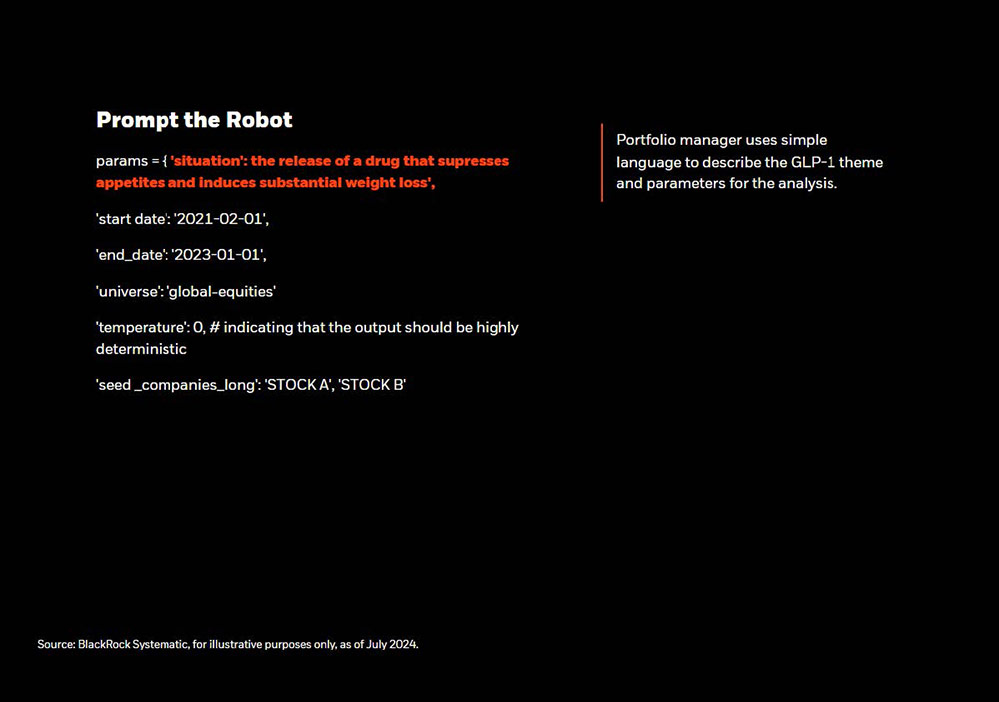

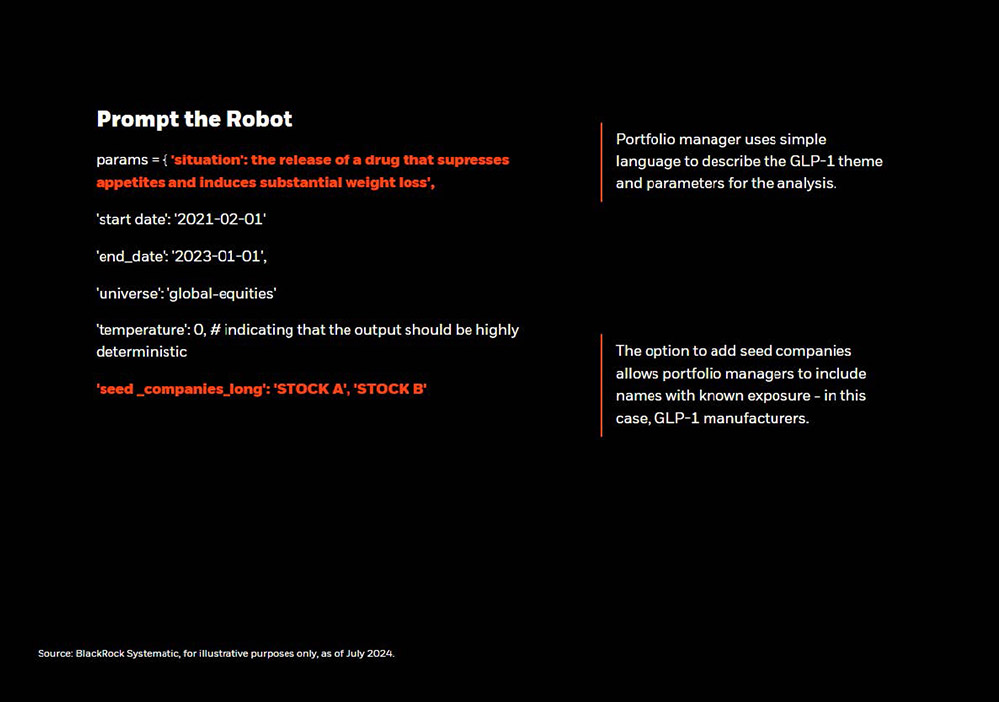

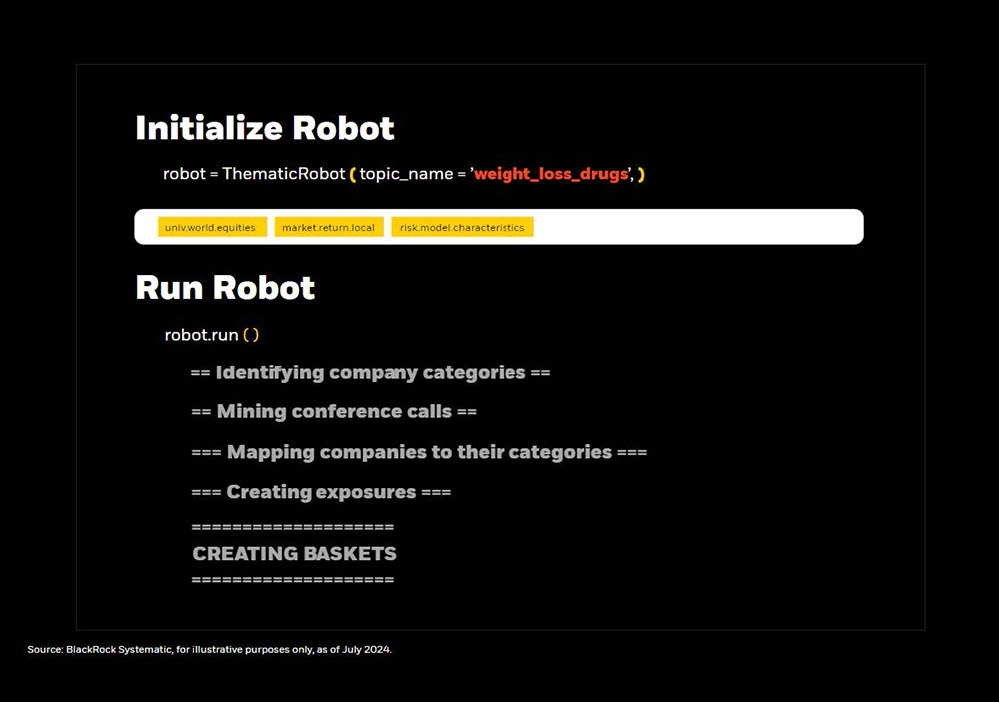

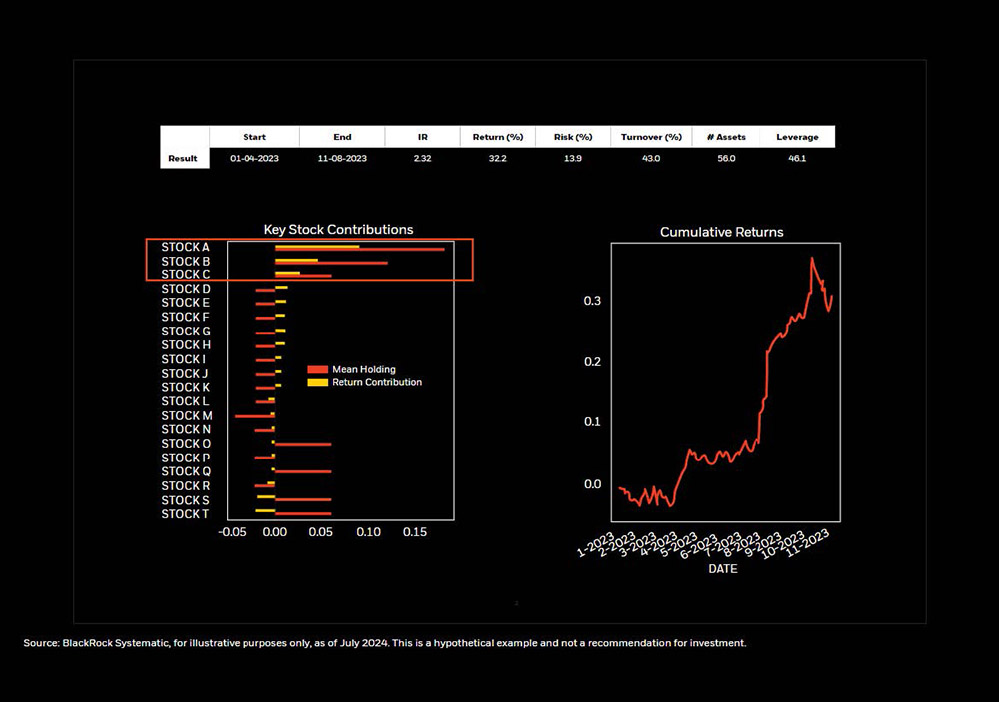

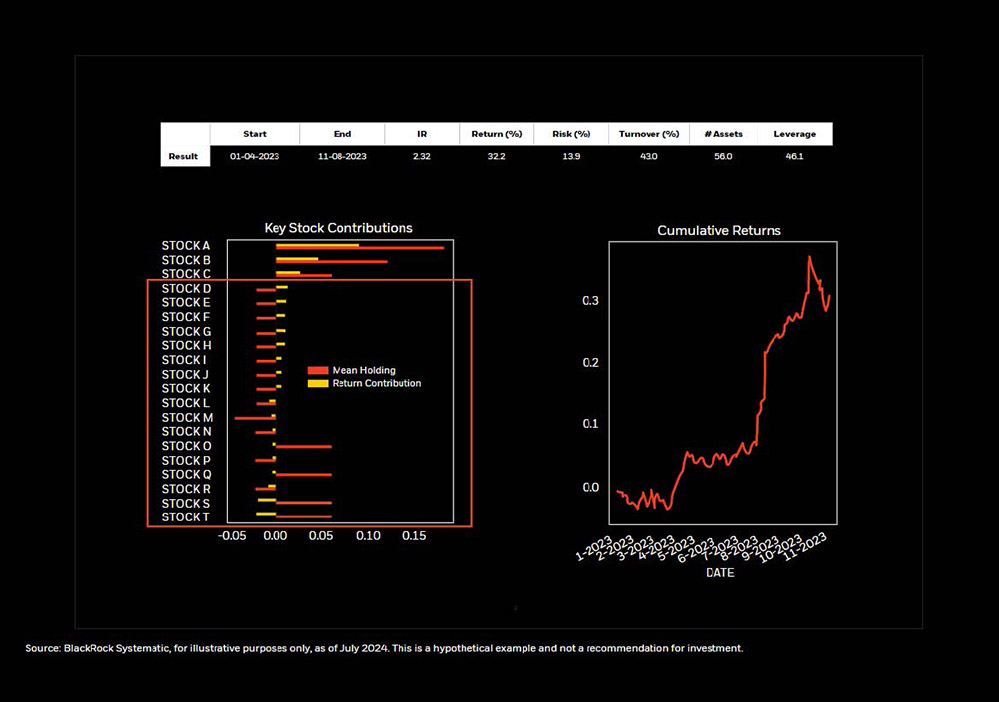

An example of this AI revolution is BlackRock's Thematic Robot, which allows portfolio managers to combine human expertise with machine learning for more efficient and diversified portfolios. Unlike traditional asset management tools, this robot is trained to predict stock performance, particularly post-earnings periods, enabling faster reactions to market shifts. Automating complex tasks like creating equity baskets—bundles of stocks around a particular theme—has transformed how BlackRock manages assets. What once required significant human time and labour is now simplified by using AI, which can synthesize large volumes of data and adjust portfolios in real time based on new trends.

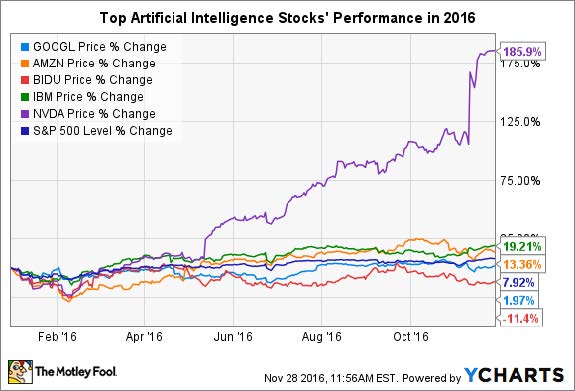

This shift is not restricted to BlackRock alone. Vanguard and other major asset management firms closely watch the rise of generative AI and machine learning technologies. The increasing reliance on AI tools is reshaping how investment managers approach markets, with a growing emphasis on using data and automation to optimize returns. Nvidia, a significant player in AI chip production, benefit the most from this shift, with its chips being used to power the vast needs of AI systems across the financial industry. The integration of AI into investment strategies by asset management giants highlights the important role of technology in ensuring future competitiveness in the rapidly evolving market.

AI-powered tools are reshaping the face of investing, going through a dramatic change in how financial professionals tackle data, analysis, and decision-making. Generative AI has emerged as a pillar for that change, where investors can make the most out of machine learning algorithms to process and analyze vast amounts of information in real time. These algorithms filter through financial reports, news articles, even social sentiment, to create actionable insight that will help investors make better decisions much faster.

It can predict post-earnings reactions in the stock market, if one wishes. Built to anticipate how markets would respond in the days when quarterly earnings reports are released, a period long synonymous with full volatility for stocks, BlackRock's models can leverage AI and estimate where the market is shifting and move the portfolios optimally. It is an important developing core competency of the asset managers and has been enabling them to stay well ahead of the competitors that wholly rely on conventional methods.

Significant technological growth of AI adoption in the financial sector includes companies at the leading edge of developing chips to power these AI systems, such as Nvidia and AMD. Nvidia alone has seen its stock shoot up, for instance, as 80% of its revenue comes from AI chips. That would constitute the growth feeding both ways: technology advances drive better tools for investment, and demand for those tools fuels further innovation.

Smaller companies like Super Micro Computer also benefit from this AI boom. For example, its stock is up threefold since the beginning of 2024 and acts as something of a proxy for the wider ecosystem of companies set to benefit from the rapid improvement of AI. The success of SMC underlines the fact that the effect of AI in the investment industry goes beyond just big names like Nvidia and AMD to other firms providing specialized products and services within the AI ecosystem. The bottom line is that the adoption of AI in financial services will continue to progress, and this technology is surely seen as a critical driver of economic and market growth for years to come.

AI has taken over new, fast, innovative, and data-driven steps in investment management decision-making. This is one of the most striking effects of automation on tasks that, until recently, had been so much labor-and time-consuming, such as portfolio construction, risk analysis, and model development in finance. The robot at BlackRock enables asset

managers to build thematic investment strategies focused on sectors, trends, or specific industries with unprecedented speed and accuracy.

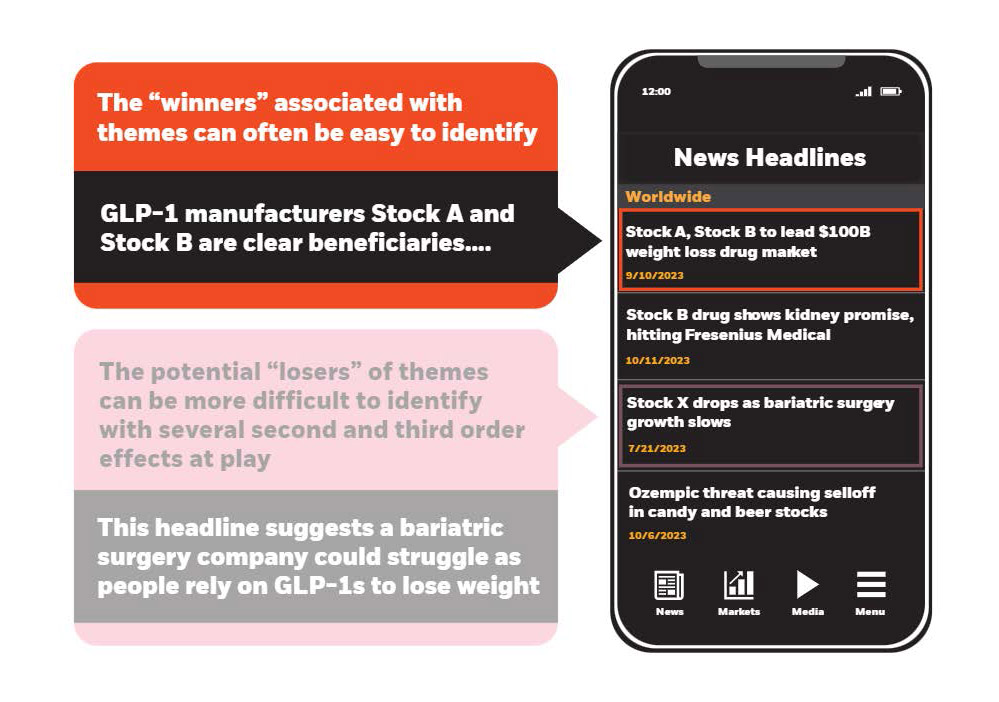

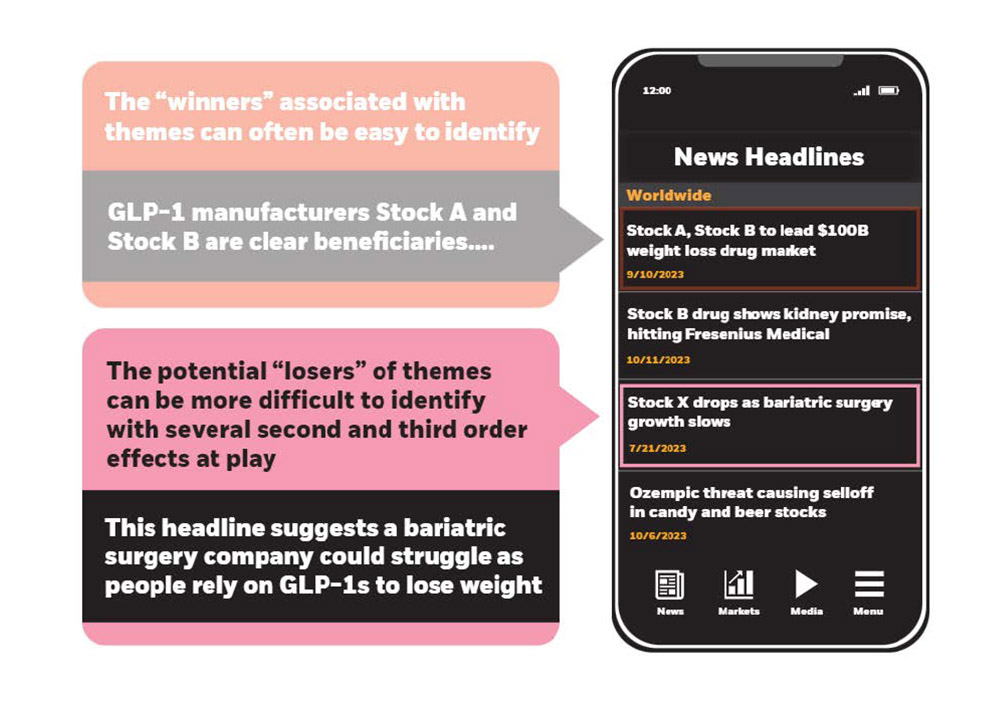

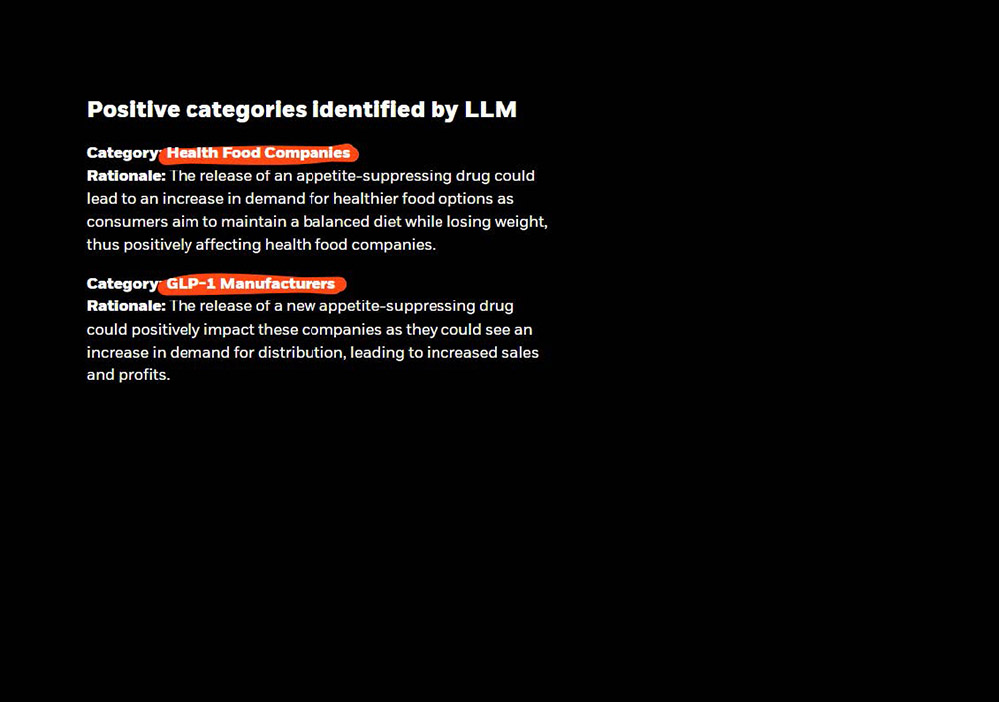

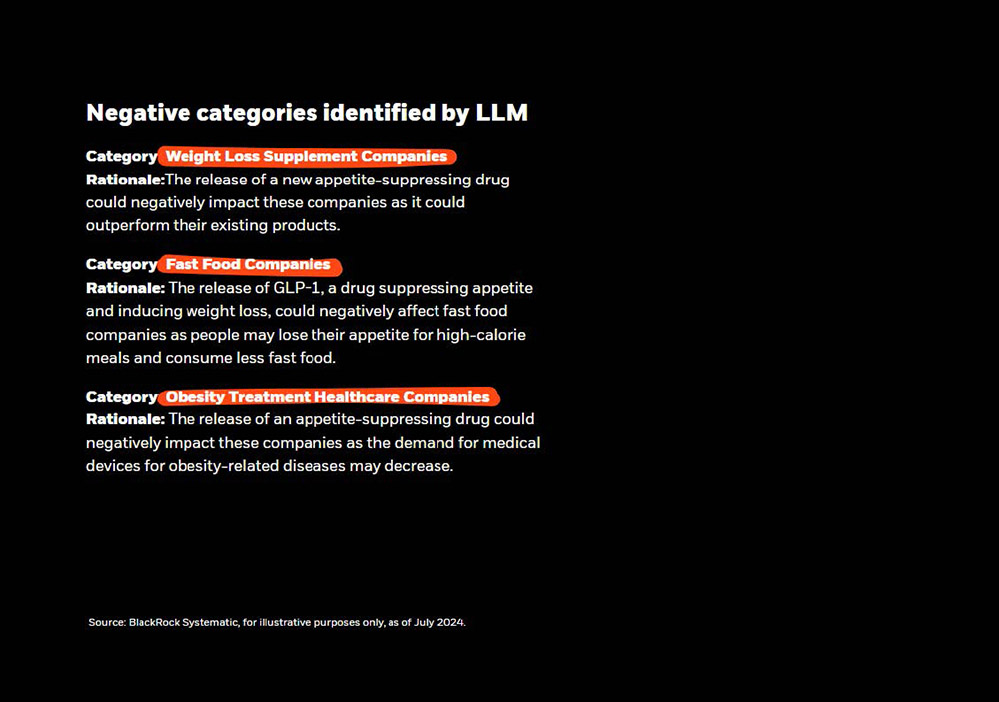

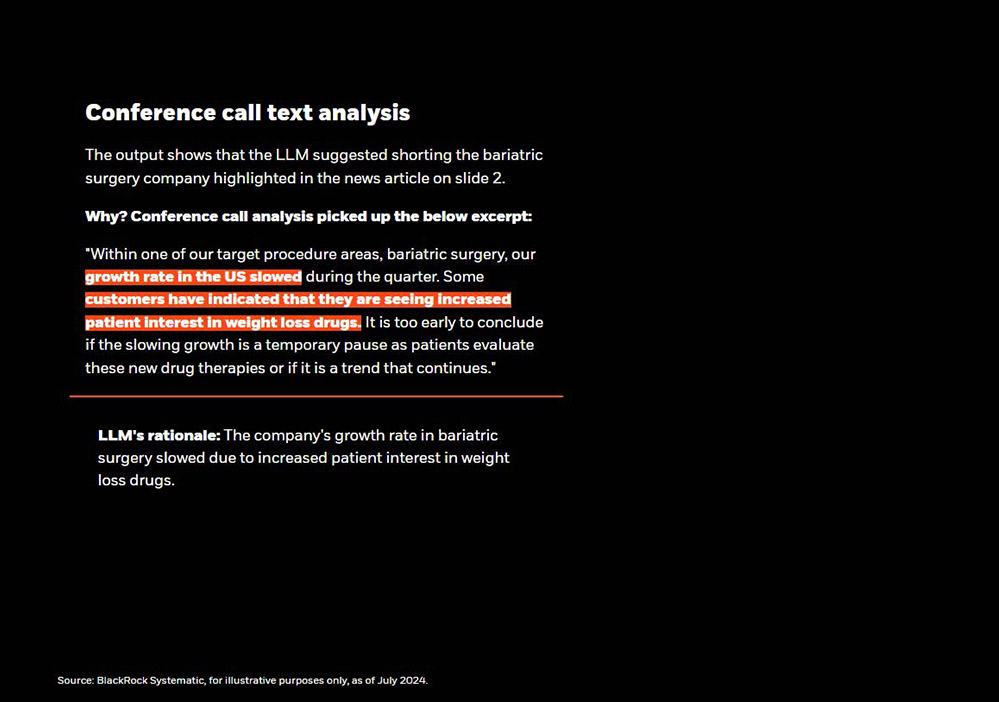

It is especially well-placed to analyze unstructured data such as financial news, earnings calls, and regulatory filings for trends that may have escaped the attention of human analysts. BlackRock employs AI-driven NLP to scan and analyze text for information that may impact investment decisions. It allows the company to identify those stocks, which are positioned to take advantage of the long-term trends, such as renewable energy or increased demand for weight loss drugs. AI systems can identify risks that could negatively impact sectors or companies, too, and the portfolio managers then take that information to make changes in the holdings.

AI also changes high-frequency trading, where algorithms are the ones performing trades in times less than those thought humanly possible. This sort of AI-powered trading system can process large volumes of market data in milliseconds and detect price discrepancies to execute impossible trades by human traders. This has, on one hand, been a great benefit to the market in terms of liquidity and price discovery. On the other hand, however, it has raised concerns about market volatility and a resultant flash crash, where rapid, algorithmic trading causes sudden significant movements in the market.

The benefits that AI offers in investing are numerous. For example, AI-driven solutions can allow for much faster decision-making because of the large volume of real-time data processed, increased efficiency, and much higher accuracy. This, in turn, enables asset managers to rebalance their portfolios rapidly, manage their risk more effectively, and uncover new investment opportunities that might have otherwise been missed. AI boosts predictive capabilities so that investors will be able to anticipate market movements better and act quickly on every change in market conditions. This level of automation and precision is a reason why the competitive landscape is being reshaped, and why those firms that use AI effectively enjoy an important advantage over their peers.

However, this rapid growth also means a number of risks and challenges. The generative models of AI are extremely powerful but have also been known to generate inaccurate or

misleading results mainly when dealing with incomplete or ambiguous data. This raises questions about the reliability of AI-driven investment strategies in case of turbulence or volatility in the markets. Besides, there are regulatory concerns. While the U.S. is holding off from regulating AI too seriously for fear of stifling innovation, figures such as Gary Gensler, head of the U.S. Securities and Exchange Commission, have cautioned that a lack of regulation might lead to systemic risks and could even trigger an economic crisis.

Another concern is algorithmic bias. The models are only as good as their training data, and if that data is biased or incomplete, the models produce skewed results. This is particularly concerning in lending, where AI is increasingly used to assess creditworthiness. If adequate precautions are not taken, AI might lead to the perpetuation of existing inequalities by denying certain groups loans or investment opportunities because of prejudiced data.

As AI becomes more ingrained in the financial sector, its use's ethical and regulatory challenges have come to the forefront. The European Union (EU) has been leading the charge in developing regulations to ensure that AI technologies are used responsibly. The Council of Europe has sponsored an initiative to draft a convention on AI that prioritizes human rights, democracy, and the rule of law. The goal is to create a legal framework that governs the use of AI in a way that protects individuals and society while still fostering innovation.

The United States, however, has taken a more cautious approach. While it serves as an observer state in the Council of Europe's initiative, the U.S. has been reluctant to impose strict regulations on AI, particularly in the private sector. This has led to a tug-of-war between the U.S. and Europe, with American companies pushing for less regulation to avoid stifling innovation and missing out on profitable opportunities. In contrast, European regulators argue that stricter rules are necessary to ensure transparency, fairness, and accountability in AI-driven decision-making.

One of the most pressing ethical concerns is data privacy. AI models rely on vast amounts of data to function, much of which is sensitive or confidential. Ensuring this data is used responsibly and securely is paramount to maintaining trust with investors and the public. Another concern is algorithmic transparency. Many AI models, especially those based on machine learning, are considered "black boxes" because their decision-making processes are opaque and difficult to understand. Regulators are increasingly pushing for more transparency in how AI models make decisions, particularly when those decisions have significant financial implications.

In conclusion, while AI offers transformative opportunities for the investment industry, its rapid development raises essential ethical, regulatory, and practical questions. As AI continues to reshape global markets, it will be critical for regulators, investors, and technology developers to work together to ensure that its benefits are realized responsibly and sustainably.